Homeowners Insurance in and around Decatur

Homeowners of Decatur, State Farm has you covered

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

Your home and possessions have monetary value. Your home is more than just a structure. It’s all the memories you hold dear. Doing what you can to keep your home protected just makes sense! That’s why the most sensible step is to get outstanding homeowners insurance from State Farm.

Homeowners of Decatur, State Farm has you covered

Help protect your home with the right insurance for you.

Don't Sweat The Small Stuff, We've Got You Covered.

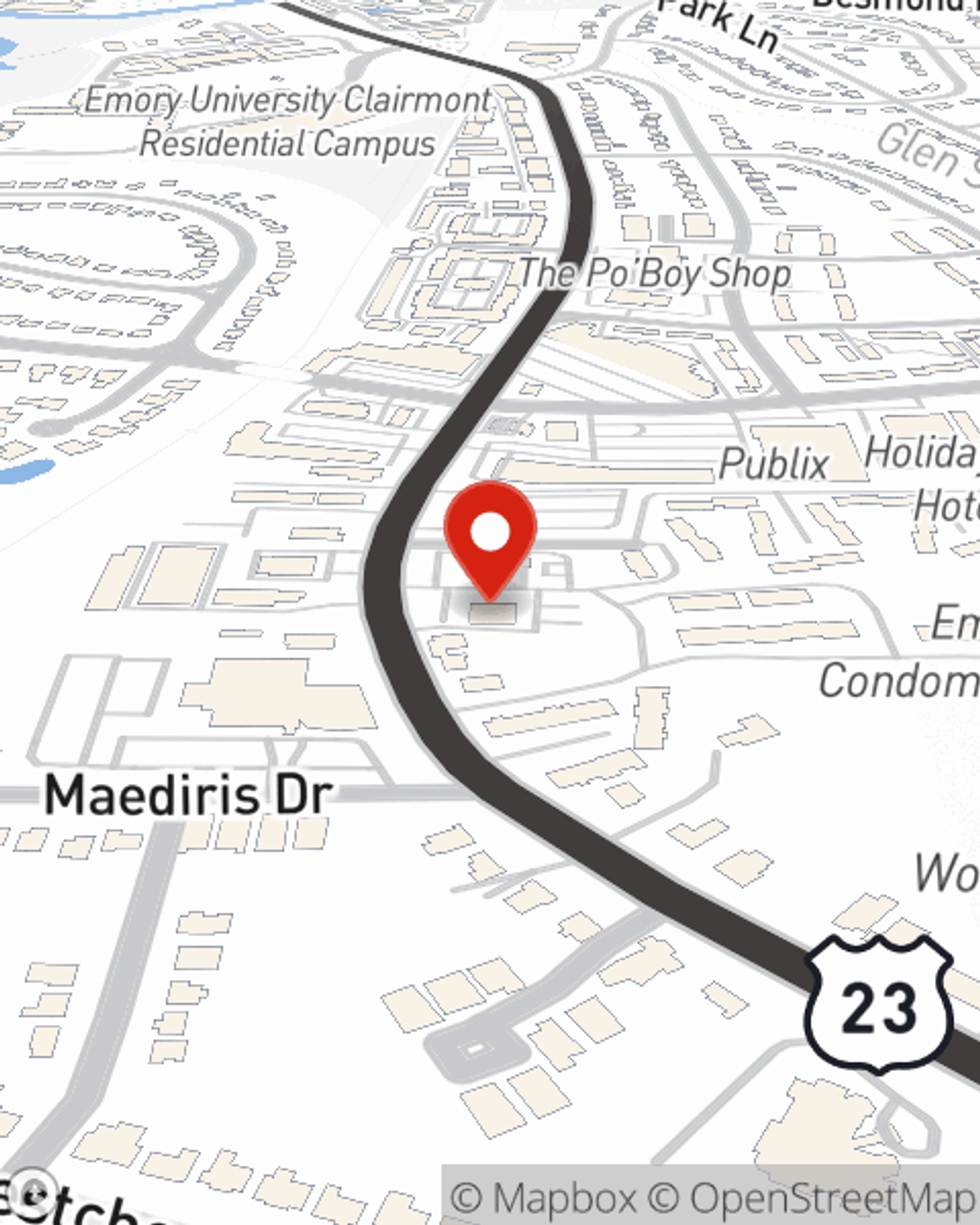

For insurance that can help cover both your home and your possessions, State Farm has options. Agent Katy Fenbert's team is happy to help you set up a policy today!

Your home is the place where your loved ones gather, but unfortunately, the unexpected circumstance is not off the table. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Katy Fenbert can help you get the home coverage you need!

Have More Questions About Homeowners Insurance?

Call Katy at (404) 636-6300 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

Flooded basement? How to deal with common causes

Flooded basement? How to deal with common causes

Wet basement problems can cost you thousands of dollars. Here are steps to help identify the source of the water and ways to minimize your risk.

Katy Fenbert

State Farm® Insurance AgentSimple Insights®

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

Flooded basement? How to deal with common causes

Flooded basement? How to deal with common causes

Wet basement problems can cost you thousands of dollars. Here are steps to help identify the source of the water and ways to minimize your risk.